For decades, the energy industry has recruited some of the best minds in geosciences and engineering to go after oil and gas — to find it, get it out of the ground, and transport it around the world.

The century-long pursuit for petroleum has sparked technological innovations. It has advanced humanity’s knowledge of the planet’s geological history and the processes that shape it. And it has led to a world that runs on hydrocarbons, requiring a vast and diverse energy infrastructure, from power plants and pipelines to gas stations and offshore drilling platforms.

But as society grapples with climate change, an energy transition is underway that is expanding low-carbon energy sources, reducing greenhouse gas emissions from hydrocarbon combustion, and cleaning up the impacts of fossil fuels and other energy sources on the environment. But far from leaving the oil and gas industry behind, it’s leveraging what it has built to new ends. And from oil fields out west, to refining infrastructure along the coast, there’s much to leverage across Texas.

At the Jackson School of Geosciences’ Bureau of Economic Geology, geoscientists are using their experience and expertise in energy research to provide the data needed to drive the energy transition forward.

“There are many possibilities, because we work extensively with government and industry in these spaces,” said bureau Director Scott Tinker, a leading voice on the energy transition. “It’s a remarkable opportunity for us, the Jackson School and Texas to continue to lead the global energy research conversation.”

The bureau was founded in 1909 as the State Geological Survey of Texas, a dual role it fills as a research unit of the Jackson School. This directive, along with organizing research around topical and industry-funded consortia, has helped orient science at the bureau around the state’s natural resources and the industries that rely on them.

As funders have started to make energy transition moves, a number of scientists at the bureau are leading research that is focused on reducing greenhouse gas emissions now and sustainable energy production in the future.

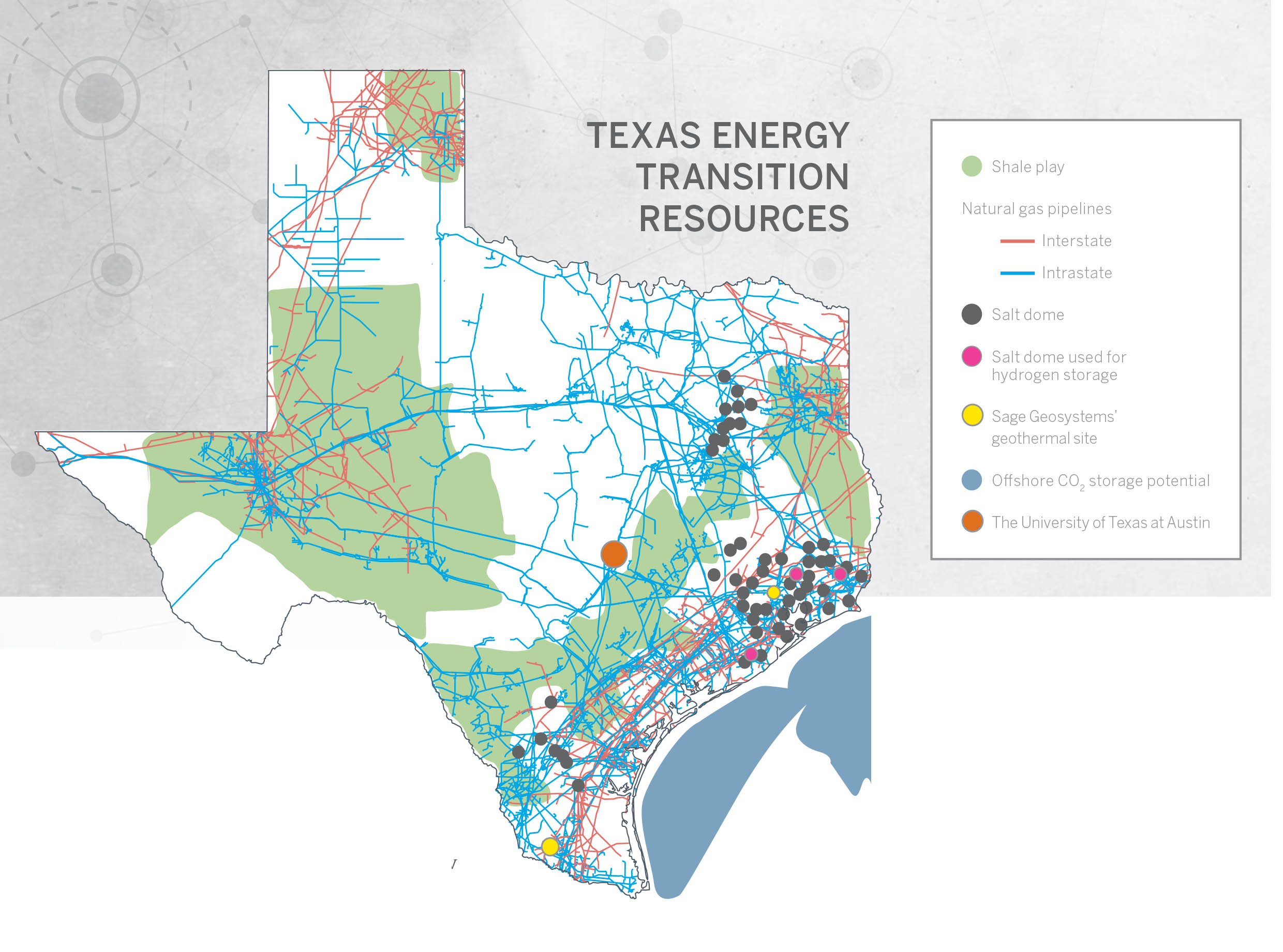

Some of the most active areas of research are centered around capturing CO2 from industrial emissions and permanently storing it underground; ramping up hydrogen production and integrating the carbon-free gas into the nation’s natural gas supply; and advancing geothermal energy in Texas and beyond.

“The subsurface is the subsurface,” said Mark Shuster, the bureau’s associate director of the Energy Division. “We see a lot of potential and synergies — and oil and gas companies do too — taking these skills and applying them to new areas that are growing, such as hydrogen, geothermal and carbon storage.”

CARBON CAPTURE AND STORAGE

The energy transition is diversifying energy sources. But for now and in the near future, fossil fuels still power the world. Carbon capture and storage technology is poised to play an influential role in the transition because it enables industry to continue using hydrocarbons while reducing CO2 emissions.

The technology works by capturing CO2 right at the source of combustion, and compressing, moving and injecting the gas directly into the subsurface for permanent storage, allowing industry to reduce emissions while providing energy to the world.

Susan Hovorka has been leading research on the technology at the bureau’s Gulf Coast Carbon Center for the past 20 years. For most of that time, conversations came from others within a relatively niche scientific community. But in recent years, she said, interest has exploded.

She points to the American Association of Petroleum Geologists hosting a special program on the technology in March 2021 as a sign that carbon storage had entered the mainstream conversation.

“There has been real growth and interest from professional societies,” said Hovorka, who chaired a session on best practices on carbon capture and storage at the conference. “I feel we’re in good company.”

As a concept, carbon capture and storage is not new to the oil and gas industry. Since the 1970s, oil companies have been producing and capturing CO2 from natural and industrial sources and injecting the gas into depleted oil reservoirs to increase production, a technique called enhanced oil recovery.

But while the energy industry has helped advance both the capture and injection technologies, until the Gulf Coast Carbon Center got involved with research, there was little field-based data on how CO2 behaved in the subsurface, Hovorka said. That’s largely due to the inherent low risk associated with enhanced oil recovery: the volumes of CO2 injected into the subsurface are usually relatively small compared with other reservoir fluids; the increased pressure that comes from adding CO2 is stabilized by removing the hydrocarbons released from rock pores; and the CO2 is kept from migrating by the same geology that trapped the oil in the first place.

But if the goal is to store CO2 underground to keep it out of the atmosphere, getting a handle on CO2 in the subsurface is the essential first step to ensuring that the gas is stored safely and permanently.

In September 2004, researchers at the center took the first steps in demonstrating that CO2 could be safely stored underground by leading the Frio Brine pilot experiment, the first CO2 storage field test in the United States outside of an oil and gas context.

Funded by the Department of Energy and bringing together collaborators from national labs, universities and industry, the experiment injected a total of 1,850 tons of CO2 into brine-bearing sandstone of the Frio Formation near Dayton, Texas, with researchers closely monitoring how the gas behaved in the subsurface during two injections. They first injected 1,600 tons of CO2 5,050 feet below the surface over 10 days, with scientists monitoring the plume for 18 months. The second injection took place in 2006, two years after the first, with scientists introducing about 250 tons of CO2 into a hydraulically separate formation about 390 feet deeper than the first injection site over five days.

The project was a clear success, said Hovorka. The integrated suite of seismic imaging, geophysical monitors and chemical tracers worked in tandem to provide a clear view of CO2 in the subsurface. The experiment helped refine models for CO2 behavior. And, critically, there were no leaks detected at the surface, as confirmed by techniques developed by the research team.

The Frio experiment helped gather important scientific information about storing CO2 underground. But it also benefited from broad expertise of the oil and gas industry, too, Hovorka notes. The research team included scientists from Schlumberger and BP. The property where the experiment took place belonged to Texas American Resources Company, an independent oil company owned and operated by Jackson School alumnus Don Charbula. Hovorka also credits the UT legal team’s oil and gas experience with getting the project greenlighted by university officials.

“Because UT was able to understand that the risks were acceptable, and because we had alumni in the oil business, we were able to take this nice step forward for everybody,” Hovorka said.

Frio is just one example of the Gulf Coast Carbon Center leveraging oil and gas expertise to conduct fundamental science. One of the most significant research findings came from analyzing Gulf of Mexico well logs first collected by oil and gas companies and later compiled by the Gulf Basin Deposition Synthesis (GBDS) program, a research group at the University of Texas Institute for Geophysics, another research unit of the Jackson School.

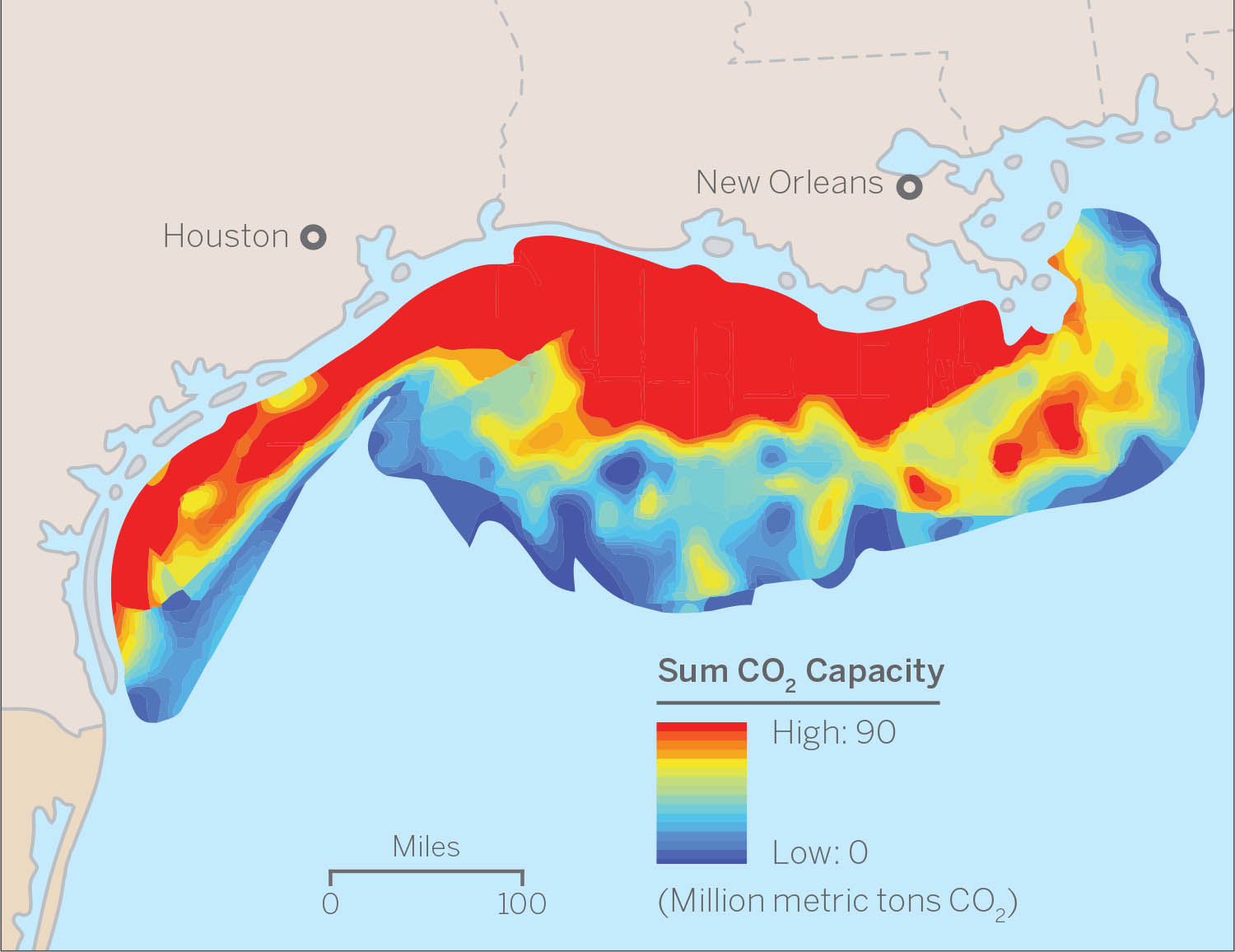

Well logs record the geological properties of a well. Oil and gas companies used this information to determine where to drill for oil. The GBDS group used it to create maps of the geological history of the Gulf of Mexico. And in 2011, Hovorka and the Gulf Coast Carbon Center team used the same information to estimate the CO2 storage capacity available along the offshore Gulf of Mexico.

They calculated 559 billion metric tons, tripling the known U.S. offshore storage capacity at the time.

The Department of Energy took notice when Hovorka mentioned the findings to an assistant secretary after a talk, which was followed, in 2013, by Hovorka and Tinker meeting with Secretary of Energy Ernest Moniz in Washington, D.C., to present the concept of offshore CO2 storage. This led to others taking note, too.

“This was all ours, 100 percent ours,” Hovorka said. “We were the ones who brought interest in the offshore back to the U.S. and DOE got interested, and industry got interested, and the state got interested, and so we did something important.”

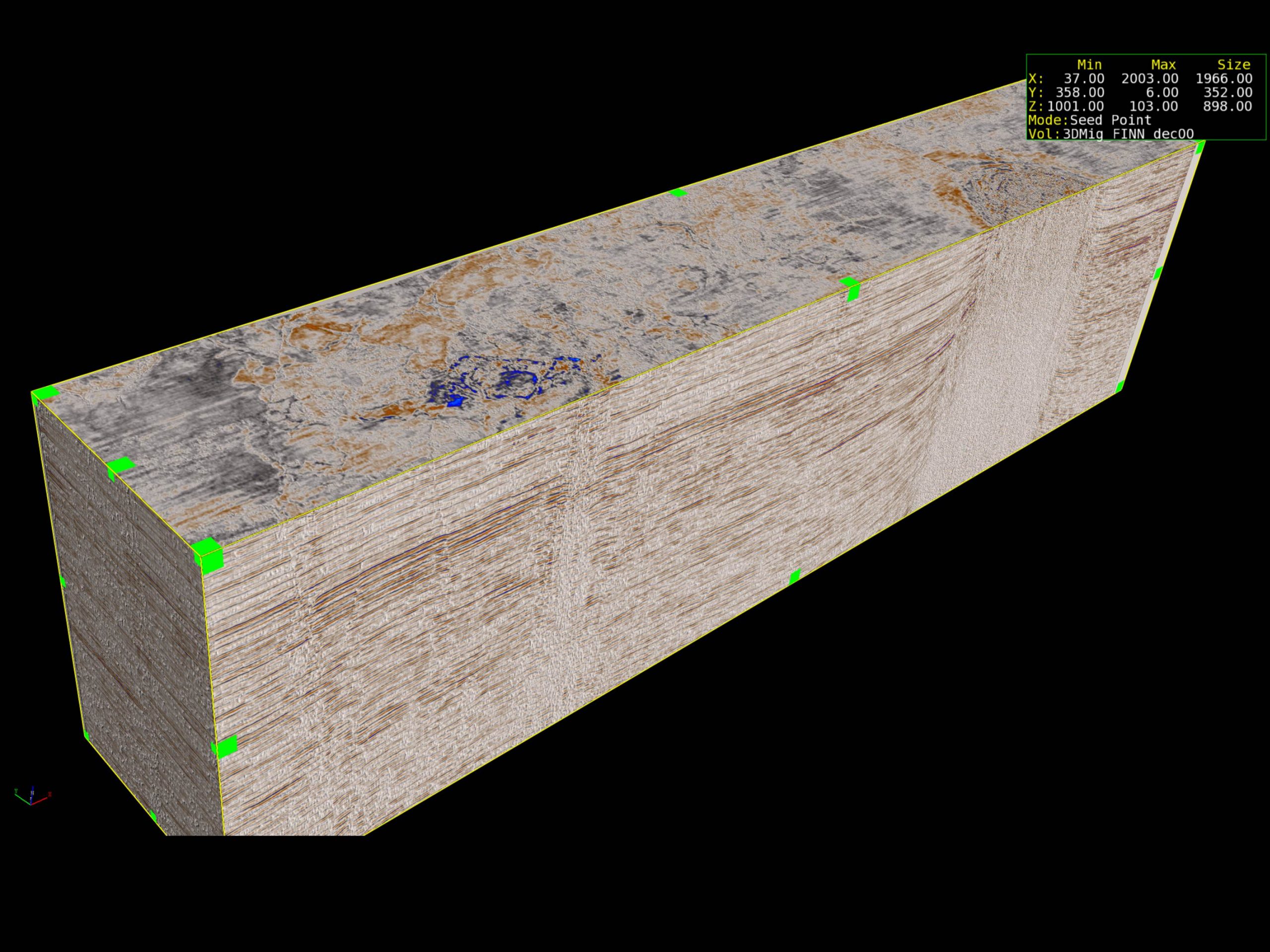

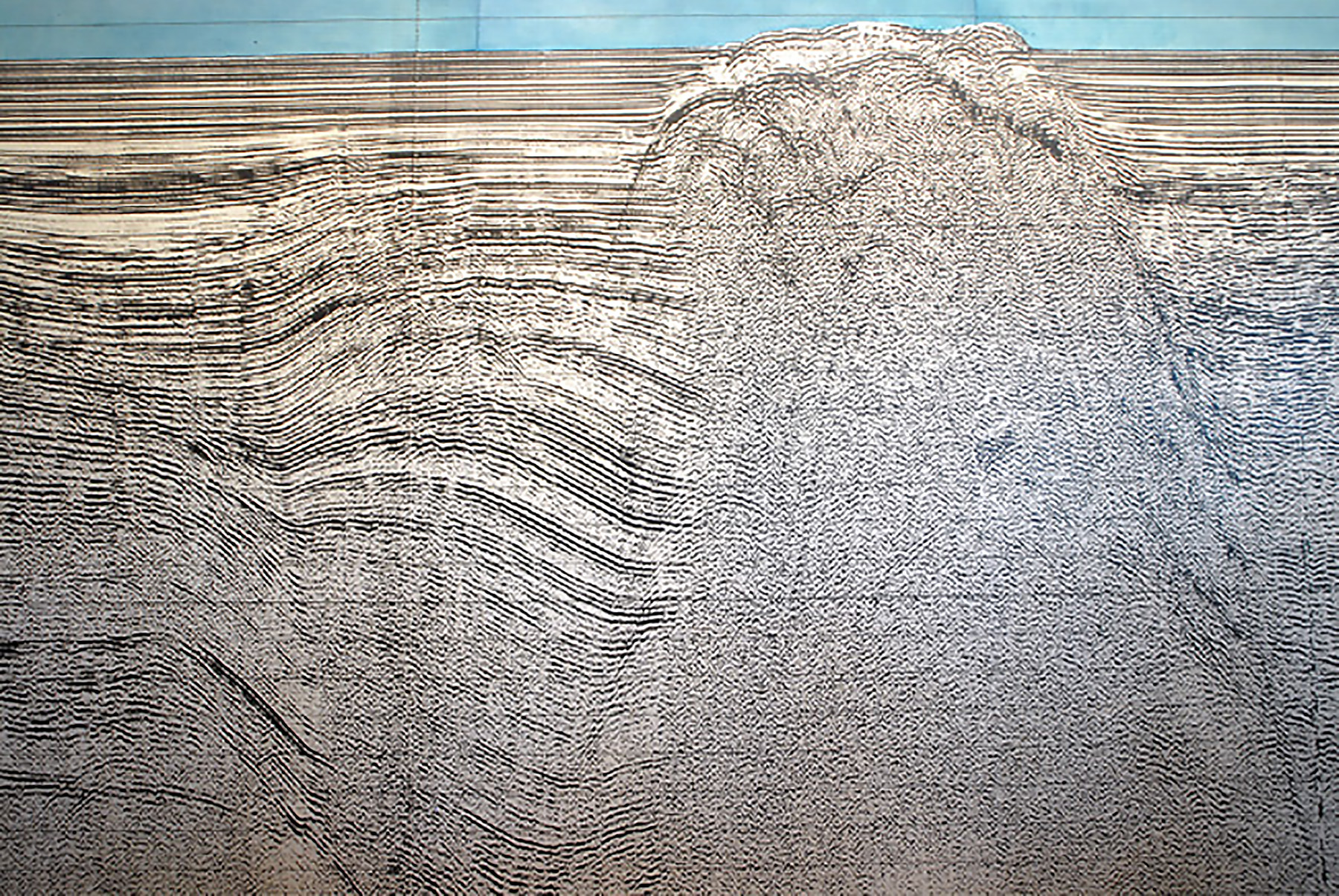

Hovorka made her initial storage estimates by poring over paper copies of the well log data with a master’s student and a magic marker, but the capacity estimate has not significantly changed over the years, she said. What has improved is knowledge of the geological formations that make up that space, with bureau Senior Research Scientist Tip Meckel leading seismic surveys using state-of-the-art technology that captures detailed reservoir features in 3D. The scope of research has also expanded. From regulations to infrastructure to engineering, all aspects of carbon storage in the Gulf of Mexico are subjects of study, with the center serving as an organizing hub for partnerships with other universities, national labs and geophysical companies.

As awareness of carbon capture and storage has grown, the center hasn’t just benefited from oil and gas data and partnerships with industry. It has become a place for scientists with oil and gas experience to apply knowledge directly to carbon storage research.

“We get hundreds of applications, hundreds of letters of interest every year,” Hovorka said. “There are all kinds of motivations, but many come specifically from people who have oil and gas backgrounds who want to shift their emphasis.”

Arnold Oseiy Aluge and Melianna Ulfah are two examples of such scientists. They both got involved with research at the Gulf Coast Carbon Center while earning master’s degrees from the Jackson School’s Energy and Earth Resources (EER) program. Oseiy Aluge earned an undergraduate degree in chemical engineering from the University of Lagos in Nigeria. During his studies, he held a research internship with Shell, where he worked on converting waste plastics to synthetic crude oil. Ulfah spent the first three years of her post-undergraduate career working offshore of Indonesia as a geophysicist at Total and Pertamina, the country’s national oil and gas company.

Both Oseiy Aluge and Ulfah enrolled in the EER program with carbon capture in mind. The projects they ended up taking led them in two different directions: Oseiy Aluge analyzed different economic scenarios that could help make carbon capture and storage in depleted reservoirs offshore of Louisiana profitable, even when oil prices are low. Ulfah conducted research on how the number of CO2 injection wells and their placement influences the amount of gas a geologic unit can hold, with Ulfah using the results to make leasing acreage recommendations in a final report.

Now, both Jackson School alumni as of spring 2021, they’re continuing to work in energy, Oseiy Aluge as a power market analyst at McKinsey, Ulfah as a fellow at Lawrence Livermore National Lab, where she is looking into the CO2 storage potential of Northern California’s basins.

“Coming from a background of oil and gas, working as an oil and gas professional, it really makes me look at my life and my time at UT as contributing to the energy transition while also transitioning myself from oil and gas to cleaner sources of energy,” said Ulfah.

And it’s not just early-career professionals making the transition. Research scientist associate Alex Bump, the newest addition to the Gulf Coast Carbon Center’s research staff, joined the group in 2019 after spending 16 years in global exploration at BP, where he worked on over 50 basins on five continents and served as head of discipline for structural geology and tectonics. His research still draws heavily on that experience. But instead of exploring frontier basins for oil and gas, he is now repurposing those skills to study CO2 storage plays. He said that as he climbs the learning curve himself, he is working to bring others along with him, designing training in carbon capture and storage for petroleum geoscientists and helping oil companies, data brokers and others identify new business opportunities in carbon storage.

The center has been characterizing the Gulf Coast for decades, steadily growing a knowledge base. In May, Meckel, Hovorka, Bump and Ramón Treviño, a bureau program manager, published a paper in Greenhouse Gases: Science and Technology that pulls together research on geology, infrastructure and policy to provide a high-level overview of why the Gulf Coast is on its way to becoming a carbon storage hub.

Meckel, the lead author of the paper, said the study is meant to serve as a road map, offering policymakers and decisionmakers in the energy industry a primer on what the Gulf Coast has to offer for carbon capture and storage. Recent laws passed by the Texas Legislature this year show that the state is taking steps to set up a carbon storage economy.

In June, Texas Gov. Greg Abbott signed into law HB 1284, giving the Texas Railroad Commission similar regulatory authority over CO2 injection wells as it has over oil and gas wells. With that in place, the Railroad Commission is now seeking to become the primary regulator of CO2 wells, a function currently fulfilled by the federal government. And in May, the Texas General Land Office started accepting lease proposals for CO2 storage in state lands, with lease revenue benefiting the Texas Permanent School Fund, just as oil and gas leases do.

“We are setting ourselves up for success,” Meckel said of the recent policy decisions. “We are going to be able to use a very useful state resource to help our industry decarbonize, and in the end, the benefits are also going to come back to basically every school district in Texas.”

The Gulf Coast Carbon Center’s work on carbon capture and storage is playing a major role in developing a critical technology that can help society get a handle on CO2 emissions now while other energy technologies are developed to help carry the load that hydrocarbons do today. A key part of that effort is finding fossil fuel alternatives.

At the bureau’s newly founded GeoH2 group, researchers are investigating how the same infrastructure that shuttles natural gas across the country can help jump-start a new hydrogen energy industry.

HYDROGEN

About 40% of electricity in the country is generated from natural gas, which produces CO2 emissions. The natural gas is transported across 3 million miles of pipeline with 4.25 trillion cubic feet of geological storage in use to help hold it all.

At the GeoH2 group, scientists are working on what it would take to integrate hydrogen, which produces only water as a byproduct, into the country’s already robust natural gas system.

In May 2021, the group published a paper in the Oil and Gas Journal overviewing the natural gas infrastructure potentially available for hydrogen gas. It presents an initial goal of replacing 10% of the natural gas supply with hydrogen, a concentration that wouldn’t require widespread infrastructure changes to accommodate for the introduced hydrogen.

“We know how to move gas. We’re very experienced in it, particularly in the U.S., so it makes sense,” said Shuster, the associate director of the bureau’s Energy Division. “You have a whole suite of potential uses for the hydrogen, but it’s going to take some work, some research, and I think it’s going to take probably some targeted incentives.”

The oil and gas industry is responsible for building the natural gas infrastructure that fuels a large portion of the country. But the industry is also the primary consumer of hydrogen, which it uses to produce petrochemicals. The only three geologic storage sites for hydrogen in the United States are hollowed-out cavities in salt domes along the Texas Gulf Coast, all used to store gas for petrochemical processing.

The GeoH2 group is drawing on industry data and insight in handling both these gases to inform its own research on integrating hydrogen into the existing natural gas system.

“We see a lot of potential synergies — and oil and gas companies do too — taking these skills and applying them to new areas that are growing.” - Mark Shuster

Initial research is studying geologic storage of hydrogen. Geologic storage is how large quantities of natural gas are stored, with the gas being kept in salt domes, saline aquifers and depleted oil and gas fields. But of this storage repertoire, only salt domes are currently a proven storage option for hydrogen. Sticking to salt domes for geologic storage of hydrogen greatly limits where the gas can be stored, and storage volume. And because it takes three times as much hydrogen to provide the same power as a similar unit of natural gas, maximizing storage volume is a key part of making hydrogen power possible.

J.P. Nicot, a senior research scientist with the GeoH2 group, is investigating whether hydrogen can be stored in the same types of formations as natural gas. Hydrogen behaves differently from natural gas, Nicot said. It’s more buoyant, flows more easily, and it can participate in different types of chemical reactions with the rock, fluid and microbes in a storage site. Computer simulations of actual storage sites that swap the injection of natural gas or CO2 for hydrogen show just how much these properties matter.

Mojdeh Delshad, a research professor in UT’s petroleum engineering department, gave two examples of these simulations during the GeoH2 group’s first public presentation on July 15, 2021. One showed the Gulf Coast Carbon Center’s Frio Brine pilot experiment, with the hydrogen plume extending further and rising higher in comparison to the CO2. The other swapped a simulation of a natural gas storage site in Colorado. Here, the hydrogen migrates away from the caprock that keeps the natural gas secure and helps pressurize it for more efficient production.

“Regardless of all the experiences we have, [hydrogen] storage is challenging, and we require additional R&D to have a future that’s safe and successful storage in geological settings,” Delshad said.

Nicot said that field experiences are a necessary step in that R&D process. He said that small-scale, well-monitored hydrogen storage experiments, conducted in a manner similar to the Frio Brine pilot project, could go a long way in advancing hydrogen storage research — and getting hydrogen into the marketplace faster.

“You’re not going to convince a company to do it for real only with models,” he said, adding that the bureau is well positioned to lead field testing. “We have done that sort of experiment with CO2 and with regular gas, so we know how to do it.”

Figuring out where to store hydrogen is important. But another key aspect of hydrogen as it relates to the energy transition is the matter of making the gas. Currently, about 98% of hydrogen is produced by reacting natural gas with steam, which produces a mix of hydrogen and CO2. To make hydrogen a truly environmentally acceptable fuel option requires capturing and storing the CO2 emissions.

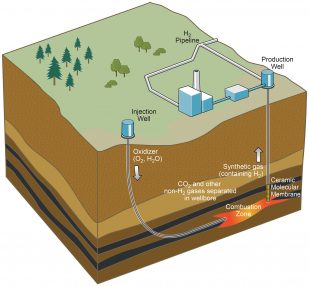

Several potential options for doing that exist, from ramping up carbon capture and storage technology to boosting the efficiency of bioreactors, where oxygen-starved algae make hydrogen instead of CO2, or electrolysis, which uses electricity to liberate hydrogen molecules from water. Senior research scientist Ian Duncan and his team within the GeoH2 group are in the early stages of investigating a method that extracts hydrogen directly from crude oil in depleted reservoirs while keeping all other emissions in the ground.

Called in-situ hydrogen generation, it works by turning a reservoir into an underground chemical processing plant, catalyzing the same reactions that generate hydrogen from natural gas in industrial processes carried out at the surface. The hydrogen is separated using selective ceramic membranes and brought to the surface. Other emissions, including CO2, are kept in the ground or injected back into the subsurface.

In 1985, BP, conducting experimental studies of in-situ combustion of oil (a standard enhanced oil recovery approach) at the Cold Lake heavy oil field in eastern Alberta, unexpectedly produced hydrogen and carbon dioxide in small but irregular volumes. More recently, the Canadian startup Proton Technologies has been in the early stages of producing hydrogen in-situ from oil sands reservoirs in Saskatchewan. But by and large, the technology has received little research attention, especially in the United States.

Duncan is working to change that, providing an overview of the technology and its potential at the GeoH2 meeting. He noted that with 50% of oil discovered in the United States still in the ground, there is a large energy supply for which to put in-situ hydrogen production to work.

“The potential for low-cost [hydrogen] integration with integrated CO2 storage has promise,” Duncan said at the closing of his presentation. “It’s going to be difficult. It’s going to be complicated. It’s going to be a challenge, but the prize will be large.”

Duncan and his research team are also investigating how excess energy produced by wind turbines and solar arrays can be put to use making hydrogen via electrolysis. The hydrogen could then be drawn upon to generate electricity when the sun isn’t shining, or the wind isn’t blowing — overcoming renewable energy’s intermittency problem.

In-situ hydrogen generation has the potential to turn hydrocarbons into a source of carbon-free fuel. And advances in electrolysis could do the same with water. But for the time being, producing hydrogen means grappling with the problem of CO2 emissions during the production phases.

Geothermal energy doesn’t have that problem. Thanks to hydraulic fracturing technology, this source of energy has the potential to go from working only in geologic hotspots to almost anywhere in the world.

The bureau is partnering with a Houston-based geothermal company to demonstrate the technology’s promise by building a geothermal power generator near the heart of Houston.

GEOTHERMAL

Texas is not a conventional geothermal prospect. Aside from a region of elevated temperatures along the Gulf Coast — which fueled an experimental 1 megawatt power plant for six months in the 1970s — Texas rocks just don’t bring the heat that most methods of geothermal energy production rely on. But for the next generation of geothermal technology, that’s not a problem.

That’s because it can transform the relatively low temperatures regularly encountered by oil and gas wells, about 100-250 degrees Celsius, into enough energy to run a small power plant. And it works by adapting hydraulic fracturing technology and other technology advancements to boost heat exchange between the rocks and circulating fluids that bring the heat to the surface.

For the past two years, the bureau has been helping mentor and support startups working to adapt techniques that began in the oil and gas industry to the geothermal sector as part of UT’s Geothermal Entrepreneurship Organization (GEO). In May 2021, it partnered with one of those startups, Sage Geosystems, on a project to bring geothermal power to Ellington Field Joint Reserve Base in Houston. “It has good potential to be the project that really breaks ground in this new paradigm in the U.S. and definitely in Texas,” said Ken Wisian,

the bureau’s associate director of the Environmental Division and a retired major general in the Air Force, who is representing the bureau during the project. “Proving the viability of this new geothermal technology in the oil capital of the world — Houston, Texas — will get the kind of attention that it wouldn’t get if it were done in conventional geothermal zones in the western U.S.”

Wisian’s background couldn’t be better for the project. He earned a Ph.D. in geothermal geophysics while serving in the U.S. Air Force, and from 2009 to 2011, he was commander at Ellington Field.

Before work gets started at Ellington, the bureau and Sage are testing the geothermal technology in South Texas, converting an abandoned exploratory gas well in Starr County drilled by Shell in 2008 into a field test site. The well reaches 19,000 feet into the subsurface, but the Sage system does not need to go that deep. The plan is to run the experiment at 12,000 feet, collecting data on fluid flow, pressure and temperature, which will help determine the effectiveness of Sage’s proprietary technology and the construction plans for the Ellington Field well.

But old oil and gas wells could do more than serve as test sites. Through its “Wells of Opportunity” initiative, the Department of Energy is supporting research that is repurposing these old wells to tap geothermal energy. Sage’s chief operating officer, Cindy Taff, said that the company and the bureau are planning to continue development of the Starr County well into an energy producing well — and potentially could leverage knowledge gained from that to transform other old wells in the area.

From existing infrastructure to drilling and completion technology to subsurface expertise, there is much overlap between the worlds of oil and gas and geothermal. Sage’s leadership team all have oil and gas backgrounds, with Taff having spent 36 years in the petroleum industry and serving as vice president of unconventional wells and logistics for Shell’s global operations before joining Sage.

“Geothermal is such a natural segue from oil and gas to renewable,” Taff said. “You’re drilling a hole in the ground, but instead of going for oil and gas, you’re going for heat.”

At Sage, that expertise has resulted in three proprietary geothermal designs: HeatRoot, which collects heat via downward-oriented fractures; HeatLoop, where multiple lateral wells are connected with a fracture network or through lateral wellbores; and HeatFlood, which uses hot, produced fluids to heat a working fluid in a downhole heat exchanger.

Each design uses supercritical CO2 as a circulating or working fluid to collect the heat from the subsurface and use it to power an electricity-generating turbine.

At Sage and other geothermal companies, what geothermal design works best depends first and foremost on the underlying geology. The bureau helped advance knowledge of what the state’s geothermal landscape looks like by leading mapping campaigns in the 1970s and 80s. Wisian said that new geothermal technology calls for new assessments. He is working with the UT Energy Institute on a Mitchell Foundation-funded project that will do just that for the entire state, drawing on well logs, rock cores and other data to conduct a new analysis.

“It’s appropriate to do a new assessment of Texas, particularly with an eye towards these new technologies,” Wisian said. “The potential of geothermal anywhere changes the picture, and it needs to be evaluated in that context.”

The well at Ellington Field is projected to generate about 3 MW of power for a secure micro-grid on the base. That’s plenty to power Ellington. But it’s less than 1% of the 830 MW capacity of the natural gas-powered Deer Park power plant just a couple of miles from the base.

What low-temperature geothermal wells lack in sheer megawatts produced, they make up for in scalability, Taff said. The specially designed CO2 turbine is relatively small — about the size of a large desk — with most components able to be kept underground. If a customer needs more geothermal power, it can keep adding wells. This build-as-you-go approach creates an energy system that can grow with power needs. It also makes for a more resilient power grid. If one well goes offline, it doesn’t affect the rest.

If the Ellington Field project is successful, it will be among the first — if not the first — to demonstrate geothermal technology working in lower-temperature rocks, according to Taff. However, she said that when it comes to its impact in the energy transition, the true measure of success for geothermal will be cost. The electricity produced by geothermal needs to be affordable to consumers.

The fact that low-temperature geothermal is working in the same depth and temperature domains as oil and gas, using the same drilling techniques and equipment, can help keep those costs low — as well as provide work for what’s been oil and gas sector jobs, Taff said.

“We can basically use the off-theshelf drilling techniques, off-the-shelf drilling equipment, and people in the oil and gas industry know how to drill,” she said. “You don’t have to train them. You don’t have to invent anything new, and that makes wells cheaper.”

The opportunities for oil and gas expertise in geothermal energy was the key message at Pivot 2021, a four-day, public, online conference on geothermal energy hosted by GEO in July and attended by more than 14,200 people in 103 countries, with Taff and Wisian taking part in panels.

In her opening remarks, GEO’s executive director, Jamie Beard, explained how the term “pivot” applied to the energy transition.

“A pivot is a transition, but it’s just a lot faster,” she said, quoting GEO principal investigator and internet entrepreneur and engineer Bob Metcalfe. “Pivot is all about engaging the right minds to get geothermal development going at exponential growth during the next decade.”

TEXAS TOGETHER

Texas is in a good position to do that for geothermal. But as the diverse research streams at the bureau show, it doesn’t stop there. When taken together, a new energy landscape starts to emerge across the state, branching from the infrastructure of the oil and gas industry.

But in addition to refineries, pipelines and other structures, the oil and gas industry has brought another critical resource to Texas: people, many of them geoscientists. The state’s public universities play an important role in educating them to navigate the rich energy landscape across the state. “The Texas geoscience workforce pipeline is unparalleled,” Meckel said. “People come from all over the world to go to UT and Texas A&M to learn energy science.”

As scientists at the bureau conduct energy transition research, they’re training the next generation of geoscientists to take on the energy challenges facing society. In some ways, this work is continuing to do what they’ve always done: fundamental earth science with an eye toward application and serving the state of Texas. In other ways, Meckel said, it’s allowing for whole new opportunities for growth in the geosciences, at the bureau and in the energy industry as a whole.

“I grew up in Houston, and I have great friends all along the Gulf Coast, and you know that every time a hurricane comes, we don’t just build back. We want to build back stronger and use the opportunity to get somewhere you weren’t before,” he said. “I feel that this is where we are in the energy transition.”

As the energy transition continues, most of the conversation has focused on strategies for reducing CO2. Tinker said that although this is an important goal, policymakers and companies must not lose sight of the fact that sustainable energy production is more than just carbon. It’s also providing safe, reliable energy access for all populations around the world, while also preserving the environment and investing in natural resources.

“The energy transition must continue to lift the world from poverty to prosperity, which takes a lot of energy,” he said. “It must also clean up the impacts of all forms of energy on the environment. That includes emissions from combustion of fossil fuels, but also mining impacts to produce and dispose of materials for wind turbines, solar panels, batteries and more at scales never seen before. Geoscientists are needed in every phase.”

The University of Texas at Austin

Web Privacy | Web Accessibility Policy | Adobe Reader